The existence of several firms active in digital twin technologies, as well as supportive government measures, have contributed to the growth of the digital twin market. As a result of the COVID-19 issue, critical infrastructure businesses are focused on strategic alliances to support development projects.

Germany is known for its advanced technological capabilities and will play an important part in the development of the European market. In the country, digitization is taking place on a wide scale in several sectors such as healthcare and infrastructure. Many domestic businesses have responded by developing digital twin solutions.

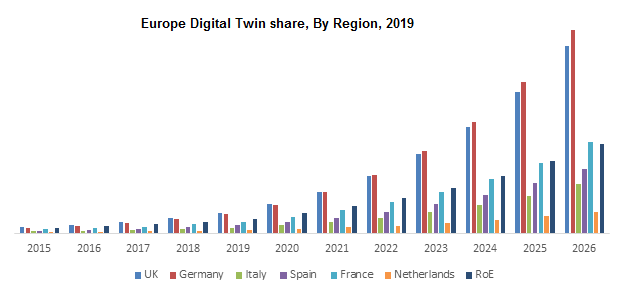

Europe Digital Twin Market share was estimated to be USD 1 billion in 2019 and is expected to register a lucrative growth with at a CAGR of over 30% between 2020 and 2026 and is expected to surpass a valuation of $9.5 billion. The region is well-known for the development and application of innovative technology in a variety of industries. Owning to the growing need for virtual technologies and high-end analytical tools to assist in creating future processes across industries, digital twin technology has gained traction in various European countries in recent years.

Europe Digital Twin Market Share[1]

By providing a proposal for a pan European digital twin standard, an open-source digital twin platform integrating IoT and image technologies, and a set of tools and demonstrated procedures to apply the platform and the standard proven to guarantee specified productivity, cost, and safety impediments, our project, ASHVIN will strive to enable the European construction industry to significantly improve productivity while reducing costs and ensuring absolutely safe working conditions.

The integration of digital twin technology with practically every stakeholder presents a strategic solution to address challenges across the full spectrum of ASHVINS asset’s life cycle. The benefits of digital twins are varied; however, they can generally be categorized into the following three key business drivers:1.) Creates a centralized database and single source of truth. 2.) Supports decision-making for allocating investment dollars. 3.) Accelerates continuous process optimization.

Three factors that shape the business value of digital twins of built environment:[2]

- The long-term source of value for digital twins results from savings in operations, maintenance and learning for new development of buildings and infrastructure. Scale of operations is necessary to leverage that value, and it requires long periods of time. Thus, the business models must either address large clients only, or they must aggregate small scale owners and operators to create a critical mass of value. This suggests that the ‘low hanging fruit’ i.e., the main clients for digital twins of buildings and infrastructure are large scale public or private owners and operators.

- The value of digital twins for infrastructure is stored in the information. Digital twin vendors can generate value by generating, organising and making information accessible, rather than selling software, which would fast become a commodity.

- Digital twin models cannot be compiled by the staff of building or infrastructure owners, for two reasons: a) highly specialized knowledge is needed for compiling digital twins, and b) the effort for compiling a digital twin is concentrated at the start of their life.

Short Terms Prediction for Digital Twins

According to the EY report on Digital Twin: the Age of Aquarius in construction, construction productivity has steadily declined since 1964, the digital twin presents an opportunity to shift archaic business models to the Age of Aquarius. Construction and real estate have operated on simple hand-made drawings for thousands of years. Only recently are we seeing the very basics of digitization come into play. Technological innovation paired with the digital twin will take us to this next coming of age. With global housing crisis, consistently exceeding budgets and schedules, global warming, pandemics, slowing production, demographic changes, more demanding workers and greater globalization, the world cannot afford to wait for digital enhancements to mature at the traditional pace. The most innovative companies realize this; hence ASHVIN can take advantage of this and suggest companies to adopt. While it is still too early to provide an assessment of the impact of the COVID-19 outbreak, the construction sector has been and is expected to be significantly affected. In fact, a recent survey conducted by an EU construction association shows that 62% of construction sites have been significantly affected or even closed throughout the first quarter of 2020– causing productivity loss, delays and additional costs. In addition, construction investment has declined following the potential drop in the number of building permits, administrative bottlenecks for processing such permits and the potential absence of the workers. As explained by a stakeholder interviewed for this study, while contracts already signed are expected to be completed (thus maintaining a certain level of activity), new contracts are still uncertain. Following the outbreak of COVID-19 epidemic, it is becoming ever more apparent that digital technologies will play an increasing role in what will be the recovery but also the new normal of the sector. As highlighted in a recent study, this new normal is an opportunity for disruption and growth. Indeed, during the COVID-19 outbreak, the construction sector partly shifted towards remote ways of working: architects and engineers are relying more heavily on BIM 4D and 5D to re-plan projects and adapt schedules. In addition, Digital Twin solutions are also increasingly used from start to end of the construction project. In the longer-term, trends such as offsite construction are also expected to pick up, following the need to build in controlled environments (which is even more important in a world that requires close management of the movement and interaction of workforces). A recent study[3] confirmed this finding – adding that over 50% of survey respondents (global construction companies decision makers) have already increased investment notably in digitalisation and supply-chain control.

Do you want to know more about our project? You can go through of all our public deliverables from here and follow and share your opinion with us through our LinkedIn, Twitter or YouTube communities.

[1] Europe Digital Twin Market Share & Size 2026 | Growth Analysis (graphicalresearch.com)